-

Gushu Industrial Zone Xixiang Street, Bao'an District, Shenzhen

Parsing Error

Parsing Error

If you’re in the vape or cannabis business, you already know that finding accurate, up-to-date pricing for vape cartridge boxes with windows feels like chasing a moving target. Most suppliers won’t publish their prices online. The quotes you do get often exclude critical costs like freight, duties, and wastage. And let’s be honest—many packaging articles out there are either too vague or completely outdated for what we’re facing in 2025.

[rank_math_toc]

I’ve spent years working with vape brands, cannabis dispensaries, and B2B buyers who all ask me the same questions: “What should I actually budget for custom windowed cartridge boxes?” “How do I avoid getting burned by hidden costs?” “When does it make financial sense to move from generic packaging to custom?”

This guide answers those questions head-on. We’re going to break down the real, landed costs of vape cartridge boxes with windows in 2025, examine different window material options and their regulatory implications, and introduce you to a smarter way of thinking about packaging spend—one that considers your customer’s lifetime value, not just the per-unit price tag.

Let’s dig in.

Why Windowed Vape Cartridge Boxes Actually Matter for Your Bottom Line

Here’s what I see all the time: brands treat packaging as a pure expense. They look at it like a necessary evil, something to minimize at all costs. But windowed vape cartridge boxes? They’re a completely different animal.

A well-designed windowed box does three critical things simultaneously. First, it showcases your product. Customers can see the oil color, verify the fill level, and check the hardware quality before they buy. That transparency builds trust instantly—especially important in a market where customers have been burned by low-quality products.

Second, windowed packaging drastically reduces returns and customer service headaches. When customers can see exactly what they’re getting, you eliminate that “this isn’t what I expected” problem that eats into your margins. I’ve worked with brands that cut their return rate in half just by switching from opaque boxes to windowed packaging.

Third—and this is where most competitors completely miss the boat—windowed boxes optimize what I call your “packaging cost as a percentage of lifetime customer value.” Think about it this way: if a premium windowed box costs you an extra $0.50 per unit but increases your sell-through rate by 15% and brings customers back for repeat purchases, that $0.50 investment just turned into $50+ in lifetime value.

We’re not just buying boxes here. We’re investing in customer acquisition and retention tools that happen to also protect your product during shipping.

Breaking Down the True Landed Cost of Vape Cartridge Boxes

Let’s talk about what “landed cost” actually means, because this is where most quotes fall apart. Landed cost is the total price you pay to get boxes from the manufacturer’s facility into your warehouse, ready to fill. It includes everything—and I mean everything.

Base Box Manufacturing Cost

Your base box cost depends on several variables. The cardboard type matters more than you think. Most vape cartridge boxes use either 350gsm or 400gsm paperboard—that’s the thickness and density of the material. Going from 350gsm to 400gsm might add $0.08-$0.12 per unit, but the sturdier box protects your product better during shipping and feels more premium in-hand.

Printing is where costs can spiral if you’re not careful. A simple 4-color CMYK print job costs significantly less than adding spot colors, metallic inks, or gradient effects. I generally tell brands to start with CMYK and add one spot color for their logo if budget allows. That sweet spot usually runs $0.30-$0.60 per unit at moderate quantities.

Then you’ve got finishing options. Matte lamination typically costs less than gloss. Spot UV—where you add a glossy, raised finish to specific areas—adds another $0.10-$0.15 per unit but creates that tactile experience customers remember. Embossing or debossing can add $0.20-$0.40 per unit depending on complexity.

Window Material Costs and Considerations

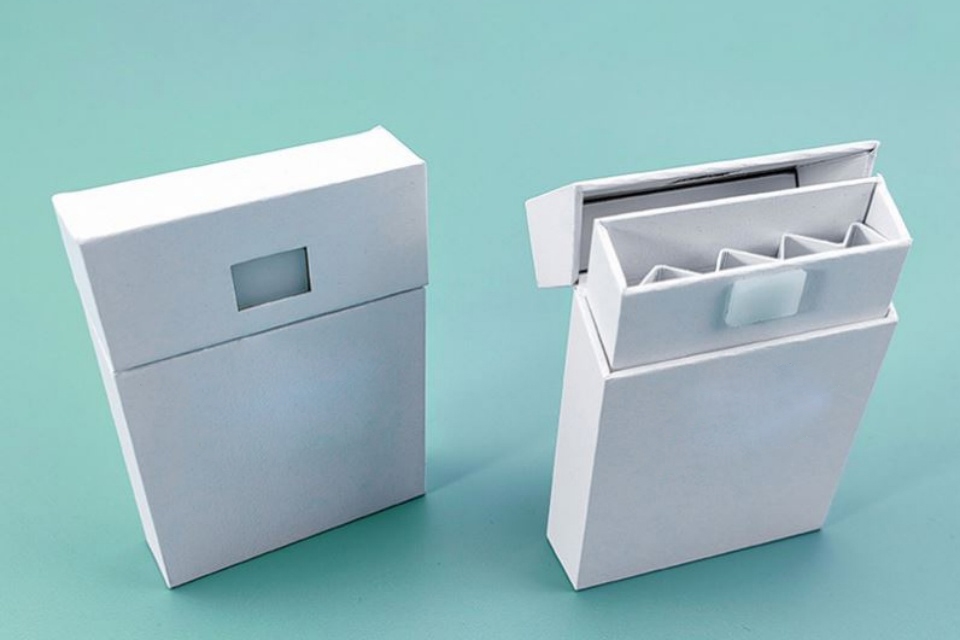

This is where things get interesting in 2025. Your window material choice affects not just cost, but compliance, environmental impact, and customer perception.

PVC (polyvinyl chloride) windows remain the cheapest option, typically adding $0.05-$0.10 per unit to your box cost. But here’s the catch: PVC faces increasing regulatory scrutiny. Some jurisdictions are moving away from PVC packaging due to environmental concerns about chlorine release during manufacturing and disposal.

PET (polyethylene terephthalate) windows cost more—usually $0.12-$0.18 per unit—but they’re widely recyclable and face fewer regulatory headwinds. I’m seeing more brands migrate to PET specifically to future-proof their packaging against upcoming regulations.

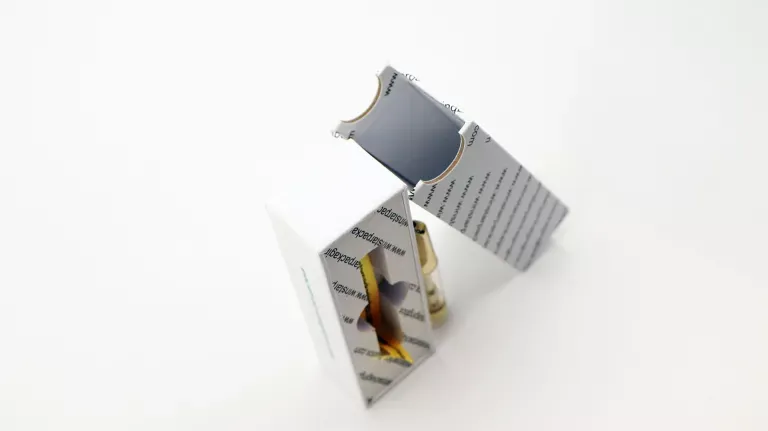

The third option is eliminating plastic entirely with a die-cut window. This approach costs less in materials but requires more sophisticated box design to ensure your cartridge stays protected. Die-cut windows work beautifully for premium brands with an environmental message, but you need to account for potentially higher damage rates during shipping.

Design and Setup Fees

Most manufacturers charge one-time setup fees that get amortized across your order. Dieline creation (the technical template for your box dimensions) typically runs $50-$150. Graphic design varies wildly—I’ve seen everything from $200 for template-based designs to $2,000+ for completely custom artwork.

Prototyping is non-negotiable. Budget $150-$300 for physical samples before committing to a full production run. Trust me, catching a design flaw at the prototype stage saves you thousands compared to discovering it when your 10,000-unit shipment arrives.

Freight, Duties, and the Costs Nobody Warns You About

Freight costs have become increasingly volatile. Sea freight from Asia to the US West Coast might run $0.08-$0.15 per unit for a 10,000-piece order, while air freight could be $0.40-$0.80 per unit. The lead time difference? Sea freight takes 4-6 weeks; air freight arrives in 7-10 days.

Import duties on paperboard packaging into the US typically run 0-4.6% depending on specific tariff classifications. Add your state and local taxes on top of that. Some brands forget to factor in customs brokerage fees—usually $100-$200 per shipment regardless of size.

And here’s the one everyone forgets: wastage allowance. Industry standard is to account for 2-5% wastage due to manufacturing defects, shipping damage, or quality control rejects. On a 10,000-unit order, that means budgeting for 200-500 unusable boxes. Plan for it upfront or get caught short when you’re filling orders.

2025 Wholesale Price Guide: What You Should Actually Pay

Alright, let’s get specific. These numbers are based on current market conditions in early 2025, assuming production in China or Vietnam (where most vape packaging originates), sea freight to US West Coast, and moderate design complexity.

For a basic custom-printed vape cartridge box with a PVC window, here’s what you’re looking at:

- 1,000 units: $1.80-$2.40 per unit landed cost. The setup fees hit hard at low volumes, and freight becomes a much larger percentage of your total cost.

- 5,000 units: $0.85-$1.20 per unit landed. This is where economies of scale start working in your favor. Setup fees are now spread across five times as many units.

- 10,000 units: $0.55-$0.80 per unit landed. This is the sweet spot for many mid-sized brands. Your per-unit costs drop significantly, but you’re not tying up excessive capital in inventory.

- 25,000 units: $0.40-$0.60 per unit landed. High-volume brands see the best pricing here, but you need strong demand forecasting to avoid inventory carrying costs.

Now, let’s compare window material options at the 10,000-unit quantity level:

- PVC window: $0.55-$0.70 per unit landed (baseline price)

- PET window: $0.62-$0.78 per unit landed (add $0.07-$0.08 for eco-friendly material)

- Die-cut no-plastic window: $0.50-$0.65 per unit landed (saves on material but may require design modifications)

These prices assume 4-color printing with matte lamination, one spot color, and standard rectangular window placement. Adding spot UV increases costs by $0.10-$0.15 per unit. Embossing adds $0.20-$0.35 per unit. Switching to thicker 400gsm board adds $0.08-$0.12 per unit.

One critical note: these are landed costs to a US port or major distribution hub. Add internal distribution, warehousing, and any additional handling to calculate your true cost per filled package.

Window Material Deep Dive: Cost, Compliance, and Strategic Considerations

Choosing your window material isn’t just about cutting costs. In 2025, it’s increasingly about regulatory compliance, environmental positioning, and supply chain resilience.

PVC Windows: The Traditional Choice Under Pressure

PVC remains popular because it’s cheap, clear, and easily formed to various window shapes. Manufacturing processes are well-established, and lead times are predictable—usually 3-4 weeks from order confirmation to production completion.

But the regulatory landscape is shifting. California’s Safer Consumer Products program has identified PVC in packaging as a chemical of concern. While there’s no outright ban yet, I’m advising clients to think carefully before committing to PVC for products sold in California. Several European markets have already implemented stricter PVC packaging regulations, and those precedents tend to migrate to US states over time.

If you’re using PVC windows, document your compliance with CPSC (Consumer Product Safety Commission) requirements for child-resistant packaging if applicable to your products. PVC can be engineered to meet these standards, but it requires specific testing and certification.

PET Windows: The Future-Proof Investment

PET costs more upfront, but I’m seeing it as the smart long-term play for 2025 and beyond. PET is widely recyclable through existing municipal programs—it’s the same material as water bottles, so the infrastructure already exists for consumers to dispose of it responsibly.

From a regulatory standpoint, PET faces minimal scrutiny. It doesn’t contain the phthalates or heavy metals sometimes associated with PVC formulations. For brands selling into multiple jurisdictions, PET provides regulatory consistency.

Lead times for PET windows are comparable to PVC—maybe one week longer in some cases. The price premium of $0.07-$0.10 per unit represents about a 12-15% increase in window material costs, but it’s typically only 4-6% of your total landed box cost. That’s a small price for regulatory peace of mind and positive environmental messaging.

No-Plastic Die-Cut Windows: The Premium Environmental Play

Eliminating plastic entirely appeals to environmentally conscious consumers and aligns with zero-waste brand positioning. Die-cut windows cost less in materials since you’re literally removing material rather than adding a plastic component.

The tradeoff? Your box design needs to be more sophisticated. You’ll need internal structures or inserts to keep the cartridge secure and protected. Some brands use a combination of paperboard inserts and strategic folding to create protection without plastic—this can add $0.10-$0.20 per unit in insert costs, potentially negating the window material savings.

Die-cut windows work best for premium products where the higher total packaging cost aligns with product positioning. I’ve seen this approach work beautifully for $60+ cartridges where the packaging becomes part of the luxury experience.

Making the Jump to Custom: When Generic Boxes Stop Making Sense

Every brand starts somewhere. Most begin with generic clamshell packaging or plain white boxes with a sticker. The question isn’t whether to move to custom packaging—it’s when.

Generic packaging typically costs $0.15-$0.35 per unit depending on style and volume. It’s cheap, readily available, and requires zero design investment. But it does absolutely nothing for your brand. You’re competing on price alone when your product sits next to identical packaging from five other brands.

Here’s my rule of thumb: once you’re consistently moving 2,000+ units per month, it’s time to seriously evaluate custom packaging. At that volume, you can order 10,000 custom windowed boxes and turn that inventory every 4-5 months. Your cash isn’t tied up for long, and you’re finally building brand equity with every sale.

For newer brands worried about cash flow, I recommend a phased approach. Start with generic packaging. Once you hit consistent monthly sales of 500-1,000 units, move to semi-custom packaging—a standard box size with your custom label or sleeve. This typically costs $0.40-$0.70 per unit, giving you some brand differentiation without the full custom commitment.

When you’re ready for fully custom windowed boxes, consider a first order of 5,000 units rather than 10,000. Yes, your per-unit cost will be higher—maybe $0.85-$1.20 versus $0.55-$0.80—but you’re minimizing risk while testing how custom packaging affects your conversion rates and customer perception.

Track these metrics carefully after switching to custom windowed packaging: sell-through rate, return rate, customer acquisition cost, and repeat purchase rate. I’ve seen brands justify a 40% higher packaging cost because their repeat purchase rate jumped 25% after customers could see and verify product quality through the window.

The Lifetime Value Framework: Smarter Packaging Decisions

This is where we flip the entire conversation on its head. Instead of asking “How do I minimize packaging costs?” we should ask “What packaging investment maximizes customer lifetime value?”

Here’s a simple framework I use with clients. Calculate your packaging cost as a percentage of lifetime customer value using this formula:

(Per-unit packaging cost ÷ Average order value) × (1 ÷ Repeat purchase rate)

Let me break this down with a real example. Let’s say your windowed box costs $0.65, and your cartridges retail for $45. On the surface, packaging represents 1.4% of your product price. Seems reasonable, right?

But now factor in repeat purchases. If your average customer buys from you 3.5 times over 12 months (industry average for quality vape brands), that single packaging investment of $0.65 is supporting $157.50 in total revenue. Suddenly, packaging represents just 0.4% of lifetime customer value.

Now consider what happens if better packaging increases your repeat rate from 3.5 to 4.5 purchases. That’s nearly a 30% increase in lifetime value—and I’ve seen premium windowed packaging contribute to exactly these kinds of improvements by building trust and brand recall.

The math gets even more interesting when you factor in reduced returns. Let’s say windowed packaging cuts your return rate from 4% to 2%. On 10,000 units sold, that’s 200 fewer returns to process. If each return costs you $8 in processing, restocking, and lost product, you just saved $1,600—which more than covers any premium you paid for windowed versus opaque packaging.

This is why I push back when clients want to shave $0.10 per unit off packaging costs by going with the cheapest possible option. That $0.10 savings might cost you $5.00 in lost lifetime value if it leads to lower brand perception, higher returns, or reduced repeat purchases.

Supply Chain Risk: The Conversation Nobody Wants to Have

We learned some hard lessons about supply chains over the past few years. In 2025, smart brands aren’t just optimizing for cost—they’re building resilience into their packaging supply chains.

The vape packaging industry faces several specific risks worth planning around. First, raw material shortages. Paperboard production depends on wood pulp, which faces supply constraints when housing construction booms and competes for the same materials. I’ve seen 6-8 week lead times balloon to 12-16 weeks during material crunches.

Second, freight volatility. Ocean freight rates can double or triple during peak seasons or when geopolitical events disrupt shipping routes. The Suez Canal situation taught us that single points of failure exist throughout global logistics. Air freight provides a backup option, but at 3-5 times the cost.

Third, regulatory changes can happen faster than your

Comments

ASTM D3475 biodegradable pre roll packaging Bulk Wholesale Packaging cannabis branding cannabis packaging cannabis packaging compliance cannabis packaging manufacturer cannabis packaging wholesale Cheap Cannabis Packaging child-resistant child-resistant packaging child resistant cannabis packaging child resistant packaging child resistant pre roll packaging China packaging manufacturer Concentrate Container Packaging concentrate containers custom cannabis packaging custom pre-roll packaging custom pre roll boxes custom vape boxes Dispensary Packaging eco friendly packaging ISO 8317 marijuana packaging OEM/ODM OEM/ODM cannabis packaging OEM/ODM Wholesale OEM cannabis packaging OEM ODM Cannabis Packaging OEM ODM Packaging paper tube packaging pre-roll packaging Pre Roll Packaging sustainable cannabis packaging Sustainable Packaging Sustainable Vape Packaging tamper-evident Tamper-Evident Packaging TPD compliance Vape Cartridge Boxes vape cartridge packaging wholesale cannabis packaging Zhibang Zhibang China factory